Company Overview

The investment strategy of Pegasus Capital Group (PCG) revolves around seeking attractive risk-adjusted returns by focusing on a diverse range of real estate-related debt vehicles. This approach involves primarily investing in senior and private loans that are secured by both residential and commercial investment properties. By carefully selecting and underwriting these loans, PCG aims to generate favorable returns while diligently managing the associated risks.

In essence, PCG combines its expertise in real estate lending with a meticulous approach to investment selection, always striving to provide its investors with compelling risk-adjusted returns. The firm's focus on capital preservation, coupled with its dedication to maintaining a healthy margin of safety, reflects its commitment to safeguarding the interests of its investors and ensuring the long-term success of its funds.

Historical Background

Pegasus Capital Group was founded in 2021 by Dr. Jameson Lawrence ESQ. The company has evolved from a national consulting agency to an International Project Funding consulting agent who provides consultancy services on funding solutions for local as well as international clients.

This was the strategic start of PCG which later successfully completed numerous financing facilities for various clients in the local market before venturing out as an International Project Funding Agent.

PCG has successfully provided funding solutions for numerous projects for their International clients in various types of industries.

PCG's commitment and approach in providing the best funding solution for its clients has been a key contributing factor towards to where it is today.

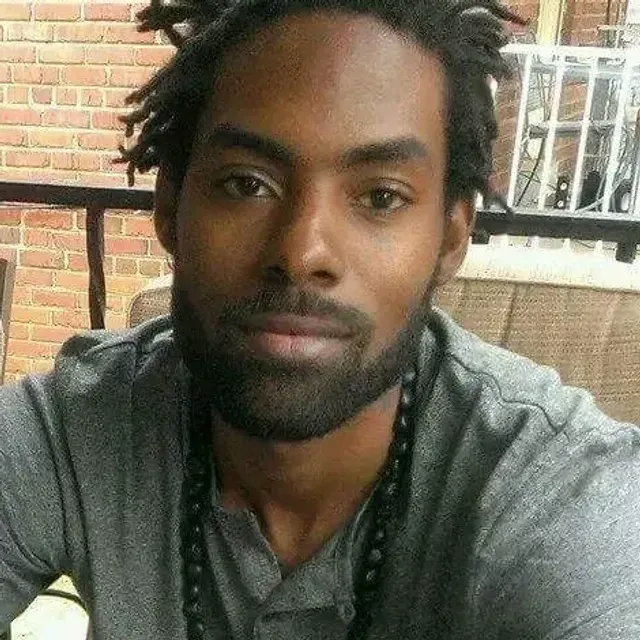

Dr. Jameson Lawrence, ESQ.

Managing Principal

Dr. Lawrence was the founder and CEO of BVFR & ASSOCIATES, LLC the award winning and highly acclaimed investment banking boutique firm specializing in providing debt financing and credit enhanced funding via the USDA BUSINESS & INDUSTRY LOAN GUARANTEE PROGRAM, USDA COMMUNITY FACILITIES DIRECT LOAN AND GUARANTEED LOAN PROGRAMS, SBA, RURAL UTILITES SERVICES, FEDERAL HOME LOAN BANK LC AND BOND FUNDING for over 20 years. He was also a principal in Chesapeake Renewable Energy which successfully developed a 4.4MW Solar energy system that resulted in a profitable exit. [CV]